deliver Q1 outcome in line with March mentality

NEW YORK – ( May 9 , 2023 ) – BuzzFeed , Inc. ( “ BuzzFeed ” or the “ troupe ” ) ( Nasdaq : BZFD ) , a premier digital media troupe for the most diverse , most online , and most socially engaged generations the populace has ever seen , today annunciate financial resultant for the first quarter ended March 31 , 2023 .

“ We have contact an inflection power point in digital media . Over the last few months , we have made meaning strategical and organisational changes to set the business enterprise for retentive - term growth . Adaptation is in our DNA . By leaning into Creators and AI , I think we can unlock young opportunities across our portfolio of trust brands — include Tasty , First we Feast , Complex , HuffPost , and BuzzFeed ” saidJonah Peretti , BuzzFeed Founder & CEO .

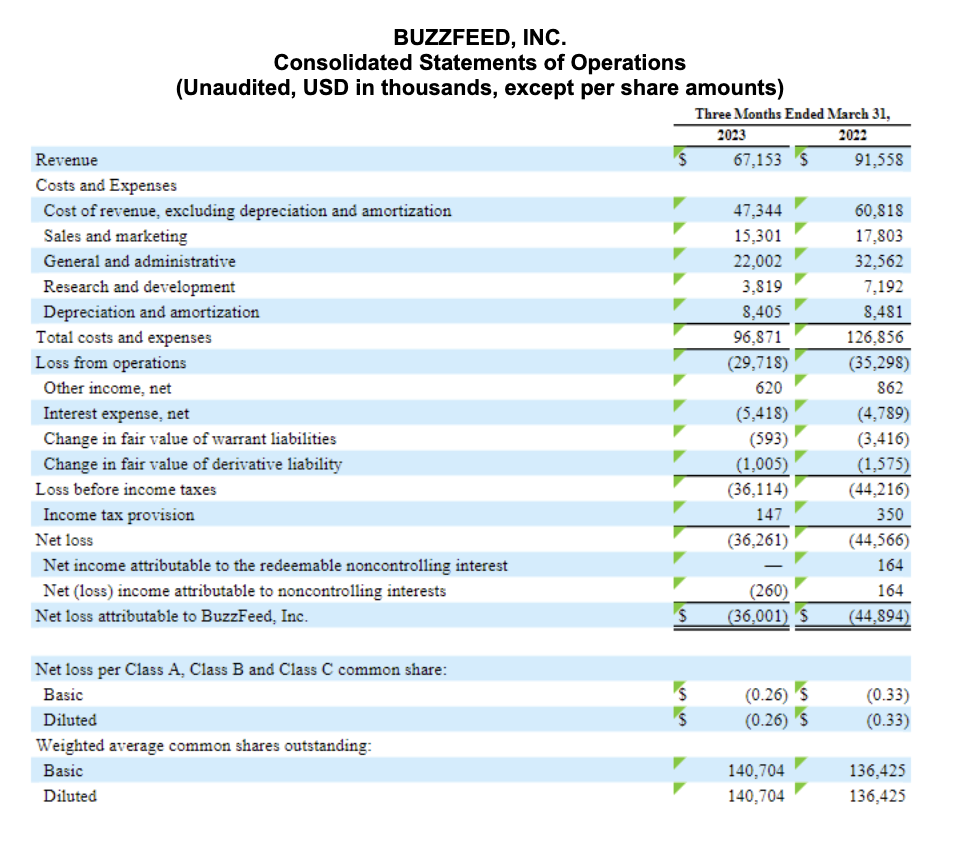

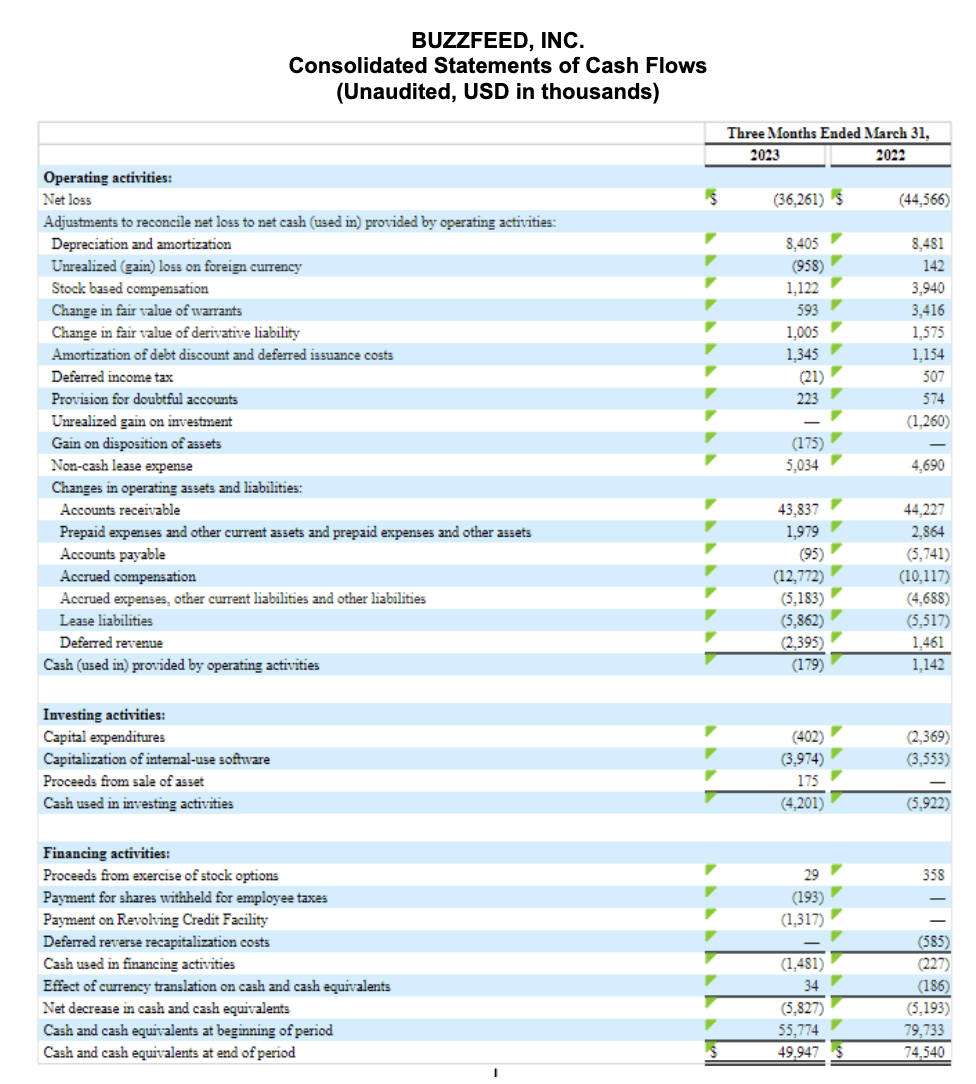

First Quarter 2023 Financial and Operational Highlights

2nd Quarter 2023 Financial Outlook

For the 2d quarter of 2023 :

These statements are ahead - looking and real results may dissent materially as a result of many factors . Refer to “ Forward - Looking Statements ” below for information on factors that could cause our actual results to differ materially from these ahead - attend statements .

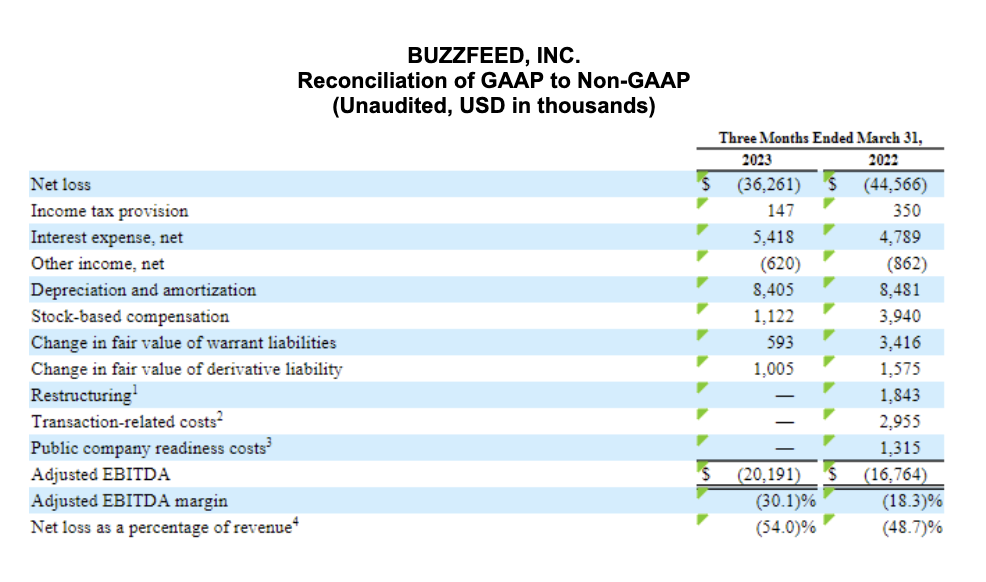

1 Adjusted Earnings Before Interest Taxes Depreciation and Amortization is a non - GAAP fiscal measure . Please come to to “ Non - GAAP Financial Measures ” below for a description of how it is calculated and the tables at the back of this net profit release for a reconciliation of our GAAP and non - generally accepted accounting principles resultant .

2 Excludes Facebook ; see below .

Please see “ Non - generally accepted accounting principles Financial Measures ” below for a verbal description of how familiarized EBITDA is calculated . While familiarised EBITDA is a non - GAAP financial measure , we have not provided guidance for the most directly comparable generally accepted accounting principles financial measure — net loss — due to the inherent difficulty in prognostication and quantify certain amount that are necessary to omen such bar . Accordingly , a reconciliation of non - GAAP steering for Adjusted Earnings Before Interest Taxes Depreciation and Amortization to the fit generally accepted accounting principles measure is not uncommitted .

Quarterly Conference Call

BuzzFeed ’s management squad will hold a conference call to talk about our first after part 2023 resultant today , May 9 , at 5PM ET . The call will be usable via webcast atinvestors.buzzfeed.comunder the heading News & upshot . To participate via telephony , please dial 833 - 634 - 1260 ( toll - free ) or 412 - 317 - 6021 ( international ) and ask to join the BuzzFeed , Inc. call . A replay of the call will be made uncommitted at the same universal resource locator .

Additionally , BuzzFeed , Inc. will be hosting a virtual Investor Day on Thursday , May 11 , 2023 at 1:00pm ET . The event will be streamed via webcast and followed by a resilient Q&A school term . Registration for the case is now open on our Investor Relations site atinvestors.buzzfeed.comand a instant replay of the event will be made uncommitted at the same URL .

We have used , and destine to continue to employ , the Investor Relations section of our web site atinvestors.buzzfeed.comas a means of disclosing real nonpublic entropy and for complying with our disclosure obligations under Regulation FD .

Definitions

BuzzFeed report revenues across three principal line of work line : publicizing , Content and Commerce and other . The definition of “ Time Spent ” is also do forth below .

Time Spentcaptures the metre audience spend employ with our message across our own and operated sites , as well as YouTube and Apple News , as measure out by Comscore . This metric excludes time spent with our cognitive content on platform for which we have minimal advertizement capabilities that bestow to our Advertising taxation , including TikTok , Facebook , Instagram , Snapchat and Twitter . There are inherent challenges in appraise the full real number of minute drop with our content across all platforms ; however , we consider the data reported by Comscore to map industry - standard estimates of the time in reality spent on our great statistical distribution platforms with our most substantial monetization chance . in effect January 1 , 2023 , we debar time spent on Facebook from our measure of Time Spent as our monetization strategy is increasingly focused on advertising on our owned and engage properties , and Facebook now contributes an immaterial amount of advertising receipts . Time Spent on Facebook , as report by Facebook , was roughly 22 million hours and roughly 72 million time of day for the three months ended March 31 , 2023 and 2022 , severally , which is not included in Time Spent discuss above .

About BuzzFeed , Inc.

BuzzFeed , Inc. is home to the best of the cyberspace . Acrosspop culture , amusement , shopping , food and newsworthiness , our brand name drive conversation and inspire what consultation watch , interpret , and buy now — and into the time to come . Born on the Internet in 2006 , BuzzFeed is committed to make believe it better : providing trusted , character , brand - dependable news and entertainment to century of jillion of hoi polloi ; making content on the Internet more inclusive , empathetic , and originative ; and inspiring our audience to hold up secure lives .

Non - generally accepted accounting principles Financial Measures

familiarized EBITDA and Adjusted Earnings Before Interest Taxes Depreciation and Amortization gross profit margin are non - GAAP financial measures and correspond fundamental metrics used by management and our board of directors to measure out the usable forte and functioning of our business , to set up budgets , and to develop operating goals for managing our business . We delimit Adjusted EBITDA as final loss , exclude the impact of net ( loss ) income attributable to noncontrolling interests , income tax provision , pastime expense , net , other income , net , depreciation and amortisation , stock - based recompense , convert in fairish value of warrant liabilities , exchange in fair time value of derivative liability , reconstitute costs , dealing - relate costs , public troupe readiness costs , and other non - cash and non - recurring item that management believe are not indicative of ongoing operations . familiarized EBITDA margin is calculated by dividing familiarised EBITDA by tax revenue for the same period .

We believe Adjusted EBITDA and Adjusted EBITDA gross profit are relevant and utile information for investor because they give up investors to view execution in a personal manner like to the method used by our direction . There are limitations to the function of Adjusted Earnings Before Interest Taxes Depreciation and Amortization and Adjusted EBITDA margin and our familiarized EBITDA and Adjusted EBITDA margin may not be comparable to similarly titled measures of other companies . Other companies , including companies in our industriousness , may count on non - GAAP financial measures other than than we do , limiting the usefulness of those measures for relative purposes .

familiarised EBITDA and familiarized EBITDA border should not be considered a replacement for measure prepared in accordance with GAAP . Reconciliations of non - GAAP financial measures to the most flat comparable financial solution as determined in accordance with generally accepted accounting principles are include at the end of this press release following the accompanying fiscal data .

Forward - Looking statement

Certain statements in this closet freeing may be considered forrader - looking statements within the meaning of subdivision 27A of the Securities Act of 1933 , as remedy , and Section 21E of the Securities Exchange Act of 1934 , as amend , which statements involve substantial risks and dubiousness . Our advancing - take care statements let in , but are not limited to , statements regarding our direction squad ’s expectation , hopes , beliefs , intentions or strategies regarding the future . In add-on , any statements that refer to projections , prognosis ( include our outlook for Q2 and FY 2023 ) or other characterizations of future events or destiny , including any underlying assumptions , are forwards - looking statement . The Word “ pretend , ” “ anticipate , ” “ think , ” “ can , ” “ think over , ” “ continue , ” “ could , ” “ estimate , ” “ carry , ” “ forecast , ” “ think , ” “ may , ” “ might , ” “ programme , ” “ possible , ” “ potential , ” “ predict , ” “ project , ” “ seek , ” “ should , ” “ target , ” “ will , ” “ would ” and similar expressions may identify forward - looking statement , but the absence of these words does not mean that a financial statement is not forrad - take care . Forward - looking statements may admit , for example , statements about : ( 1 ) anticipated trends , growth rates , and challenge in our business and in the grocery store in which we control ; ( 2 ) need for products and service and changes in traffic ; ( 3 ) change in the business and competitory surround in which we operate ; ( 4 ) developments and expulsion interrelate to our competitors and the digital sensitive industry ; ( 5 ) the impact of national and local economical and other conditions and developments in engineering science , each of which could act upon the floor ( rate and bulk ) of our advertising , the outgrowth of our clientele and the effectuation of our strategic initiatives ; ( 6 ) short quality broadband substructure in sure markets ; ( 7 ) technological development including artificial intelligence ; ( 8) our success in retain or recruiting , or changes required in , officers , key employees or director ; ( 9 ) our stage business , operations and fiscal performance , including expectations with respect to our financial and business performance and the benefits of our restructuring , including financial projections and business metrics and any underlie assumptions thereunder and succeeding clientele plans and opening and growth opportunities ; ( 10 ) our future capital requirements and sources and exercise of cash , let in , but not trammel to , our ability to obtain additional capital in the future in a higher interest group rate environment and any impacts of bank loser or any confinement on our ability to access our cash and cash equivalents ; ( 11 ) expectations regarding succeeding acquisitions , partnerships or other relationships with third parties ; ( 12 ) developments in the jurisprudence and authorities regulation , including , but not specify to , revised foreign content and ownership regulations ; ( 13 ) the anticipated encroachment of current global supply mountain chain interruption , further escalation of tensions between Russia and westerly countries and the related warrant and geopolitical tension , as well as further escalation of swop tenseness between the United States and China ; the inflationary environs ; the tight labour food market ; the continued shock of the COVID-19 pandemic and evolving tenor of COVID-19 ; and other macroeconomic factors on our business and the actions we may take in the future in reply thereto ; and ( 14 ) our power to keep up the listing of our Class A common line of descent and warrants on the Nasdaq Stock Market LLC .

The forth - face statements contained in this press passing are based on current expectations and beliefs concerning future developing and their possible gist on us . There can be no assurance that future developments affect us will be those that we have anticipated . These forrad - looking statements involve a number of risks , precariousness ( some of which are beyond our control ) or other assumptions that may stimulate existent termination or operation to be materially different from those evince or imply by these forward - await statements . These risk and uncertainties admit , but are not limited to , those agent distinguish under the sections entitled “ Risk factor ” in the Company ’s annual and quarterly filings with the Securities and Exchange Commission . Should one or more of these risks or doubt materialize , or should any of our assumption shew incorrect , actual resolution may alter in material respects from those projected in these forward - appear statements . There may be extra risk that we regard immaterial or which are unknown . It is not potential to predict or key out all such risk . We do not undertake any obligation to update or revise any forward - looking statement , whether as a result of new information , next consequence or otherwise , except as may be take under applicable securities laws .

#

Contacts

Media Contact

Carole Robinson , BuzzFeed:carole.robinson@buzzfeed.com

Investor Relations Contact

Amita Tomkoria , BuzzFeed:investors@buzzfeed.com

( 1 ) For the three months ended March 31 , 2022 , reflects costs relate with the organisational changes to align gross revenue and selling and general and administrative functions as well as changes in subject to better serve hearing demands . We exclude restructuring expenses from our non - GAAP measures because we think they do not reflect expected next operating expenses , they are not indicative of our Congress of Racial Equality operating carrying into action , and they are not meaningful in comparisons to our past operating operation .

( 2 ) reflect transaction - refer costs and other items which are either not representative of our underlying operations or are incremental costs that lead from an factual or contemplated dealing and include professional fee , integration disbursal , and certain cost connect to integrating and converging IT system .

( 3 ) reflect one - time initial set - up costs connect with the organisation of our public company structure and outgrowth .

( 4 ) Net going as a percentage of revenue is included as the most comparable generally accepted accounting principles measure to familiarised EBITDA leeway , which is a Non - GAAP measuring stick .