" The approximation that you could have one income in a household and then go buy a house and be happily ever after does not live anymore . "

As a millennial, I can wholeheartedly admit that the topic of money stresses me out. Between getting money advice from my parents my whole life to now scrolling through social media and seeing people share how they personally handle their finances — it’s all a bit overwhelming.

On that note, while we love boomers, it’s fair to say that some of themoney advicethey give to Gen Z’ers and millennials is not always great because it might not apply anymore.

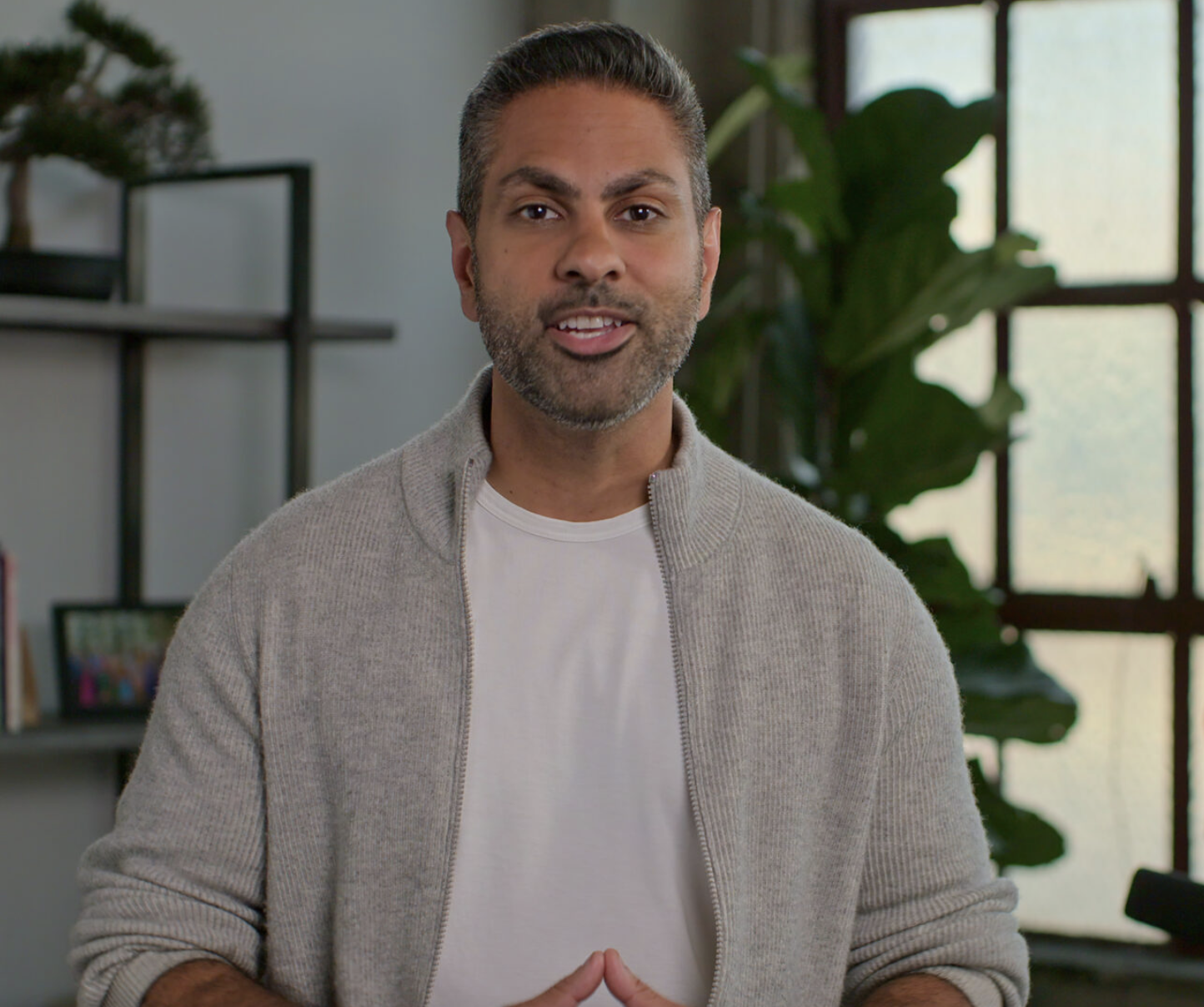

Luckily, there are people likeRamit Sethi, who is a podcast host, New York Times bestselling author, and host of the upcoming Netflix seriesHow to Get Rich. Sethi’s goal is to educate people on how to reframe their way of thinking when it comes to money. He wants people to ditch the outdated money rules our parents have ingrained in us in order to live a “rich life” (as Sethi refers to it) regardless of our income level or how much (or how little) money we have saved.

Sethi says his philosophy is about living life to the fullest — while also being financially smart. This approach is the opposite of what a lot of us have been taught our whole lives. Basically, you don’t have to sacrifice things you love in order to be money savvy.

“The idea that you’re going to get one job, stick with it for 40 years, and retire on a pension doesn’t exist. The idea that you can have one income in a household and then go buy a house and live happily ever after does not exist,” Sethi told BuzzFeed.

“A variety of things have changed, but not everything. Saving money still matters, investing money matters. It’s actually easier to save and invest now [more] than ever — it’s totally automatic. You don’t have to think about it,” he said.

While talk of today’s economy — especially inflation — is enough to stress people out, Sethi actually believes that with the right plan, people don’t need to panic as much as they do over the high cost of things.

" Sometimes when we await at the country of the world , talk to our parent , read the news — which is filled with end of the world - and - gloom headlines , including inflation — [ it can ] seem like a lot , " Sethi explained .

“If you have a solid plan with your money, if you’re tracking key numbers, you don’t need to be worrying about inflation. You don’t need to be tracking the price of asparagus, and you don’t need to be feeling guilty about buying a morning coffee,” he added.

Sethi said that although people — such as our parents — often have our best interests at heart when it comes to giving money advice, that doesn’t necessarily mean it’s the most helpful or even useful advice in 2023.

" Oftentimes , [ parent ] require safety , not excellence . They require you to be safe , and they want you to have a good line . I totally realize that . My parents came from another rural area ; of course , they require me to be safe , " he say BuzzFeed .

A lot of the financial advice that comes from older generations — or even some finance experts — is about cutting out things that bring us joy, like a $6 oat milk latte or dinner with friends, to stay out of debt and have a chunk of money saved in the bank. Sethi is advising people, especially younger generations, to reverse that mindset.

Sethi explained to BuzzFeed how people can reframe any old-school way of thinking when it comes to money by first answering a few questions. “Step one is identifying your money dials. Figuring out your money dials requires you to ask yourself,What do I love spending money on?Not like, butlove,” he said.

" So an exercise of a money telephone dial for someone can be : Number one is eating out . Number two is traveling . bit three is health and wellness . Number four is convenience , " Sethi explained .

“After you figured out your money dials, you have to know your numbers. The four key numbers you need to know are [first,] your fixed costs — that includes your rent or mortgage, your utilities, subscriptions, groceries, and everything that stays the same every month. [That] should be 50 to 60% of your take-home pay,” he said.

" The next one is your savings . [ Then ] I would hint … 5 to 10 % of take - dwelling house pay in investiture . At a lower limit , I ’d wish to see that phone number higher because every dollar mark now is worth much more later on , " Sethi tell BuzzFeed .

“Finally my favorite — guilt-free spending should be 20 to 35% of your take-home pay,” Sethi shared.

" So if you want to corrupt a cashmere perspirer , if you desire to go to a yoga class , you ’ve already planned for it . Every time you go , you ’d never have to experience guilty because automatically , your money is being hold open and invested , and your expenses are being paid while you are enjoying the thing you eff , " he further explained .

Lastly, Sethi shared even more advice on how Gen Z’ers and millennials can take control of their finances in this economy.

" you’re able to dead take restraint of your remuneration , you’re able to negociate ; that ’s a accomplishment you’re able to learn . you could automatize your savings , even if you ca n’t do 5 % , or 2 % , " he said .

For more money advice from Sethi, you can follow him onInstagram, check out hiswebsite, and also watch his new Netflix series,How to Get Rich, which premieres April 18.